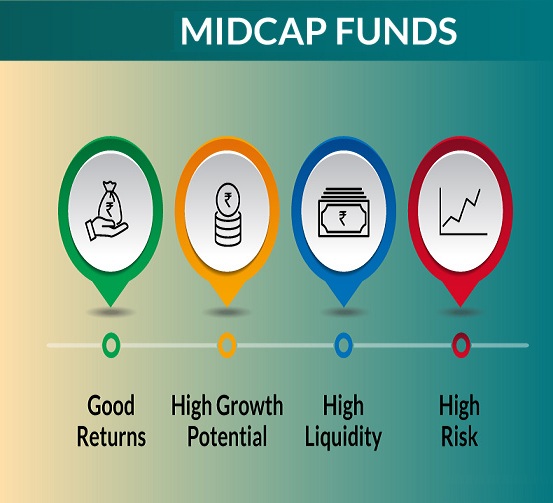

January 18, New Delhi After the recent runup, mid-cap and small-cap stocks are more expensive. Vinay Paharia, CIO, PGIM India Mutual Fund, advises prudence in weak mid-caps and small-caps in bubble zones.Strong (high growth, high quality) mid-caps and small-caps may offer long-term investors options.

We see stronger upside in large-cap stocks than mid-cap and small-cap equities and less earnings volatility for domestic consumption-oriented sectors than export-oriented sectors, he said.

Indian equities markets face premium pricing in mid- and small-cap categories, bad union election outcomes, and escalating geopolitical challenges. We are cautious on the near-term return potential of equities markets after the rapid runup, but hopeful for the medium- to long-term, he said.

The Indian equities market outperforms many global rivals due to solid domestic inflows, optimistic economic indicators, high corporate earnings growth, and steady government policies. He noted that US rate cuts, weakening USD, decreasing oil and other commodity prices bode well for the Indian economy and domestic-oriented company earnings growth, but global growth slowdown may hurt export-oriented corporate earnings in the near term.