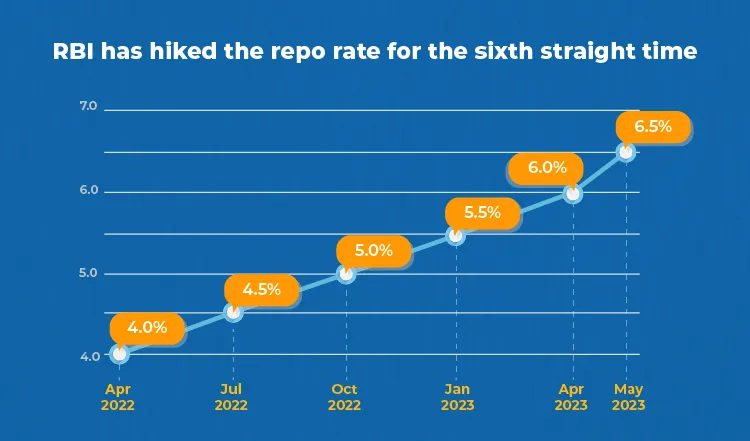

Rates have remained steady for six consecutive meetings of the central bank.

At its sixth consecutive Monetary Policy Committee (MPC) meeting, the Reserve Bank of India (RBI) has decided not to alter the rate at which it lends money to other financial institutions. This decision was made on Thursday, when the repo rate remained steady at 6.5%.

This past week, the RBI hosted its first MPC meeting following last week’s interim budget, which took place from February 6th to the 8th.

Mint, HT’s sister publication, claims that the ruling will probably not affect EMIs for borrowers. Concerning the potential effects of RBI’s ruling on EMIs, the magazine also consulted with industry experts.

According to what they stated, as we progress into 2024, the Reserve Bank of India (RBI) plans to raise interest rates in an effort to rein in inflation. This would have a major effect on the affordability of housing, according to Gunjan Goel, director of Goel Ganga Developments. In order to keep up with the demand for housing, developers could have to shoulder some rate rises. Although short-term policy changes may appear detrimental, real estate in India should be protected in the long run by the country’s economic story and demography.

The current MPC meeting has once again demonstrated the tricky balancing act between regulating inflation and fostering growth, according to LC Mittal, Director of Motia Group. Rate hikes will be necessary to rein in spiraling prices, but the prospect of higher house loan payments until 2024 could put off would-be buyers.

But compared to other countries, India’s mortgage penetration is still modest. Consequently, the secular demand trend for home ownership should remain after this cycle, even though property inquiries may temporarily fall.

Since inflation has not subsided despite previous rate hikes, another tightening in 2024 appears likely, according to Aman Gupta, director of RPS Group.

But so far this year, there has been an uneven transmission of changes in the cumulative policy rate to changes in bank lending rates. Through 2024, a more balanced transmission might be visible.

Buyer attitude should adjust, even though this will affect the serviceability of mortgages. Real estate’s long-term growth drivers are unaffected by India’s projected $5 trillion economy.